Billions of Dollars in student loan relief?

Over 10,000 student loan debts have been wiped out, and that number may rise as private lenders struggle not only to collect, but also prove their ownership of the loans. Potentially billions of dollars in debt could be wiped away due to poor book-keeping. At the center of all this is National Collegiate Student Loan Trusts, the United States largest owners of private student loans. National Collegiate has been filing suits against many borrowers in an attempt to collect the money owed. The trust has been winning many of their cases as the borrowers may not show up in case or chose debt settlement. Although it may be a better bet to fight the trust in court. Judges in many states have been tossing out many cases filed by National Collegiate due to their inability to prove they own any of the loans they attempt to collect.

Why is this

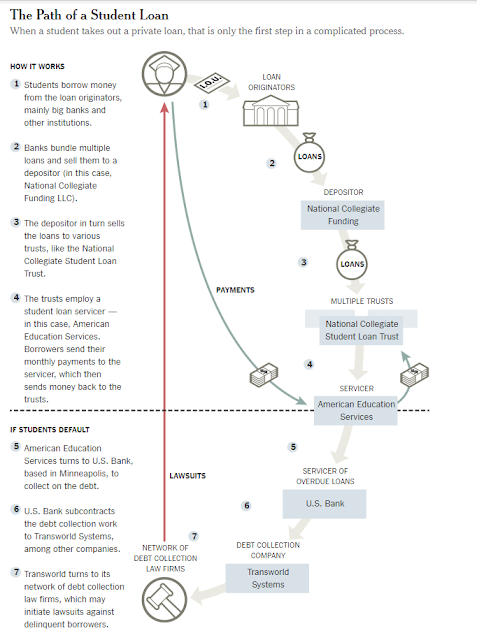

happening? As it turns out National Collegiate is an umbrella name

covering over 15 trusts that hold over 800,000 private student loans

totaling over $12 billion. What many don't realize is that once a

student successfully applies for a private loan that leads to a long

and complex process. Most remarkably the loans are bundled together

by a financing company and sold to investors through a process known

as securitization. This process has caused many of the loans to pass

through many different hands and the documentation regarding loan

ownership in many cases is lost. By the time the loan is secured by

National Collegiate all those critical documents are lost. This makes

it difficult to for the trust to make a good case in court. Likely

the biggest problem is that collecting on a loan that you do not own

is fraud.

>>For more on this story click the links below

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home